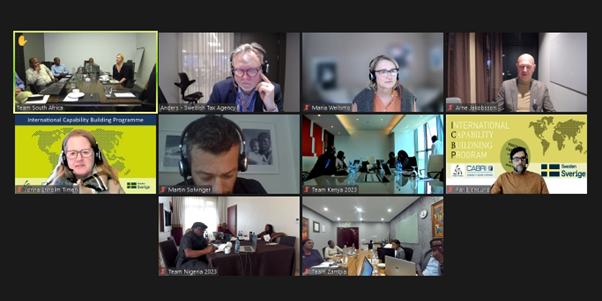

January and February were busy months for the International Capability Building Programme (ICBP) on Voluntary Tax Compliance (VTC). After going through a 5-week online course in December, participants attended a framing workshop in their respective countries, delivered by STA coaches and CABRI staff. The workshop allowed for a deeper dive into their Tax Compliance problems and identified entry points in which they will be able to effect change over the coming months. Following the framing workshop, participants also attended an online Regional Workshop, where they were presented with key factors affecting voluntary compliance, drawing inspiration from various presenters at STA, the Danish Tax Agency, ATAF, CABRI and IBP.

Over the past couple of years, both organisations have learnt significantly from the various teams on the intricacies of tax compliance in their contexts. Here are three main reflections of our 2 year of in-depth country work:

- Agencies can learn a lot about how to improve their own processes from having a taxpayer centric approach. Taxpayers are at the receiving end of tax services and their perspectives should matter to agencies whose mandate is to ultimately serve them: how do taxpayers perceive and experience paying taxes? Do agencies communicate effectively with their taxpayers? How could they make things easier for the taxpayer to comply with their obligations? These are some of the questions that any tax agency should attempt to understand. There are important lessons countries can take from the Swedish example and the various department’s missions at the Swedish Tax Agency which, at their very core, always have the taxpayer in mind.

- Taxpayer needs and wants are context-specific, and so should the solutions that tax agencies offer to them. Ultimately, countries need to follow their own path with regards to improving processes and systems that work for their taxpayers, within their unique socio-economic constraints. Communication nudges that work in Sweden may not work as well in Kenya or Nigeria. Understanding taxpayers’ unique motivations and incentives is critical to developing localised communication strategies and solutions that respond to their interests and concerns and ensure that reforms are legitimate and viable.

- Authorisation is key to getting the work done. A supportive authorising environment, who enables the team to work in an adaptive and experimental way, is critical to empower local teams to drive changes within their institutions. During the past two years, the relationships with the authorisers were strengthened, with country-teams engaging authorisers more frequently and involving them in the programme more closely. This has allowed the teams’ space for change to be enhanced.

We look forward to continuing collaborating on this programme in the next two years. This week, country-teams from the second cohort will submit their final reports, which will undoubtedly yield more learnings for both CABRI and STA!