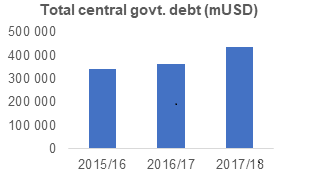

Reliable and comprehensive information on government debt is a prerequisite for making deliberative policy decisions, managing borrowing, and attracting investors. Several databases provide information on central government debt, but their coverage is limited to basic data on debt position and debt outstanding. These databases fail to identify important institutional arrangements, processes and policies, which together reveal the capacity and capability of debt offices to manage debt and associated risk.

CABRI’s latest knowledge product, the Africa Debt Monitor (ADM) will address existing information gaps by providing comprehensive information on African central government debt instruments, policies, practices and institutional arrangements. In addition to facilitating peer-learning on public debt issuance and management, the ADM will improve transparency and provide a broader section of the public, such as private investors, easier access to information on central government debt.

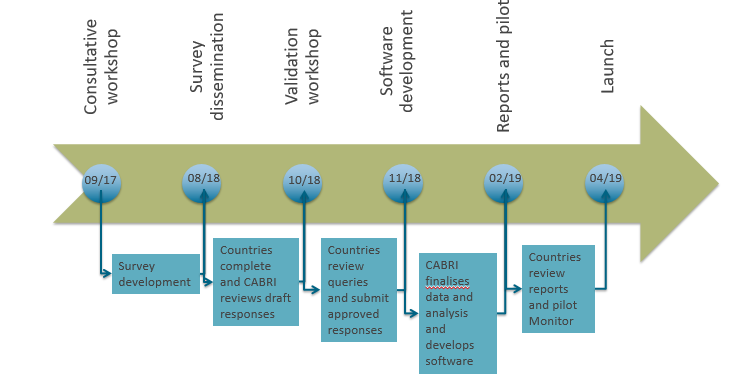

A three-part survey on (i) debt stock, instruments and interest costs; (ii) risk and contingent liability management; and (iii) institutional arrangements, policies, procedures and practices was developed in collaboration with 17 public debt managers (at a consultative workshop in 2017) and completed by 20 African countries in 2018. To ensure the completeness and validity of the survey responses, CABRI held a validation workshop with respondents on 31 October to 1 November in Mauritius.

One-on-one sessions allowed the facilitation team to work closely with respondents, guaranteeing consistency in responses, and providing the opportunity for knowledge exchange. During these sessions it was evident that respondents had gained extensive insight into their own countries’ debt position and management. Unstructured interviews were also undertaken with respondents to elicit deeper and more nuanced responses that will form the basis of three analytical reports that will be made available on the CABRI PFM Knowledge Hub.

Although 90 percent of countries surveyed subscribe to internal or international reporting standards, only half produce an annual debt sustainability analysis and more than a third do not produce debt statistical bulletins. While debt transparency is critical for internal accountability, it is also imperative for attracting investors – it is well known that investors charge for poor information. Only five countries noted that they have an investor management relationship programme and only three have a dedicated investor-relations website.

Both reporting and management of contingent liabilities were revealed as problematic. The preliminary results reflect that only half of countries’ public financial management legislation cover contingent liabilities. Several respondents have difficulty accessing information on guarantees and integrating these into debt-recording systems. This is partly due to the information on guarantees being scattered across government departments.

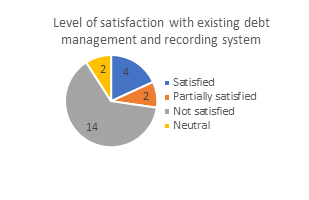

Seventy percent of survey respondents expressed dissatisfaction with their debt recording system, and only two countries developed their system in-house. In addition to difficulties with inputting guarantees, common shortcomings include that the system does not make payments, it does not interface with other information management systems and lacks reporting flexibility.

The cash management function, a key focus of CABRI’s result area on sustainable debt management, was shown to be a concern for most respondents. According to the preliminary results, while 70 percent of countries surveyed have a treasury single account (TSA), respondents indicated that accounts remain outside of the TSA. Almost all countries surveyed regularly use cash rationing and while 70 percent of countries surveyed operate a cash-flow forecasting model, 95 percent do not believe that these forecasts are accurate. Over half of the countries only produce debt-service cost forecasts annually.

Perhaps most concerning for future debt sustainability (and budget credibility) is that only 20 percent of respondents reported that the debt manager has significant influence in determining the country’s borrowing requirement. The ADM will provide debt managers with an arsenal of knowledge which they can use to increase their influence and bargaining power within the ministry of finance and more broadly. Deeper insight into potentially unsustainable practices and capability traps will also allow CABRI to improve the relevance of our debt-related work and better assist countries with improved public financial management.